As retailers gear up for another turbulent year — not to mention the next holiday season — empowering sales, operations, and marketing teams with a clear perspective of authentic consumer sentiment and a window into recent behavior is key. This is especially true for retailers with an online presence. Though shoppers are starting to return to stores and explore new ways of shopping, digital is still a key channel. Ensuring digital retail opportunities meet the expectations and excitement of holiday shoppers will be imperative in ensuring seasonal sales success.

How can we capture and forecast both the unique feelings around recent holiday shopping and shopper outlook on the year ahead? At Reach3, we leveraged our mobile chat-based, conversational approach and Rival’s mobile-first conversational platform to engage with shoppers in the US who did at least some of their holiday shopping online. (Looking for Canadian shopper data, click here)

While many expressed excitement over the opportunity to once-again celebrate with loved ones and purchase gifts for them, the weight of going “back to normal,” coupled with financial concerns, dampened the holiday cheer for some:

- “I love shopping for gifts and looking at holiday decor. Christmas shopping is fun to me. But this year, I didn't have the money to do the shopping I wanted to do. So it felt like a roller coaster - being excited about our first Christmas in our new house and wanting it to be special, but not being able to fulfill that dream.” – Female, 36-40

- “The city I lived in was more packed and thriving than usual. It was crazy busy during the holiday season and traffic was crazy hectic too.” – Female, 18-24

- “I wasn’t sure how much I would be able to afford but didn’t want to skimp out too much. I was super excited about visiting family, but the winter storm cut off our plans. We ended up getting together for New Year’s instead which was awesome. I plan on being a lot more careful with my spendings this year though.” – Male, 18-24

Here’s what to consider as you strategize for the season to come:

A Wrap on Seasonal Spending?

While shoppers may have expressed financial concerns around spending, the majority of shoppers did not report spending less in 2022 than in 2021 — In fact, 34% spent more. This was especially true of younger consumers; 48% of shoppers aged 18-24 indicated that they spent more in 2022 than in 2021 — the highest spending of all cohorts for this season. McKinsey projected similarly-optimistic trends in seasonal spending, noting a 21 point increase from 2021 to 2022 in overall consumer excitement around holiday shopping.

Shoppers also did not restrict themselves to buying gifts; while 92% purchased gifts for loved ones in 2022, 70% similarly gifted themselves. Clothing (71%), food and drink (61%), and gift cards (58%) were top of the list for holiday purchases. Looking ahead to 2023 and beyond, it is imperative that retailers not only consider shopper sentiment, but their behavior, as well. Leveraging solutions such as innovative, mobile-first insight communities can help retailers and brands capture both consumer sentiment and behaviors over time to paint a fuller picture.

Deck the Malls (...for In-Person Shopping)?

The question of where holiday shopping takes place is equally important to the topic of what shoppers are spending their holiday budgets on. The majority of our digital seasonal shoppers (72%) were cross-channel shoppers, shopping both online and in-store this past holiday season. Though many of these cross-channel shoppers (45%) did the majority of their shopping online, this is down from 53% in 2021, indicating shoppers relied less on eComm year-over-year.

While online shopping continues to be key for these shoppers, it is clear that an multi-channel approach is required to fully connect with seasonal shoppers. Understanding the unique needs and high expectations of new customers in the post-pandemic landscape will help retailers map an omnichannel strategy that delights holiday consumers…and brings them back for years to come.

(Digital) Comfort and (Shopper) Joy

Though, for many, the ability to shop online made holiday shopping easy, two-thirds of digital shoppers told us they experienced some kind of a issue in their online shopping journey, with slow shipping and out-of-stock being particular pain points:

- “Finding what I needed was like being stuck in a huge labyrinth. Many trips lead to dead ends and out of stock items. Online leads to some cancellations and multiple shipping and delivery problems.” – Male, 46-50

- “Slow shipping and missing packages ... although the insurance kicked in and I did not lose any money, the stuff I wanted did not arrive in time ...” – Male, 41-45

- “I felt like the sales were harder to come by, then when they happened, I wasn't sure if I was getting the best deal. Also, inventory was limited, so it was up and down if I could find something and what the price would be.” – Female, 51-55

When shoppers encounter issues on their digital shopping journey, this poses a threat to retailers. A third of shoppers who had an issue changed how and where they did their holiday shopping; sixty-four percent of these ultimately switched to shopping at different online retailers. Retailers will need to keep a pulse on shopper experiences across channels to ensure they meet shoppers’ needs and effectively address barriers to purchase.

Make the Nice List

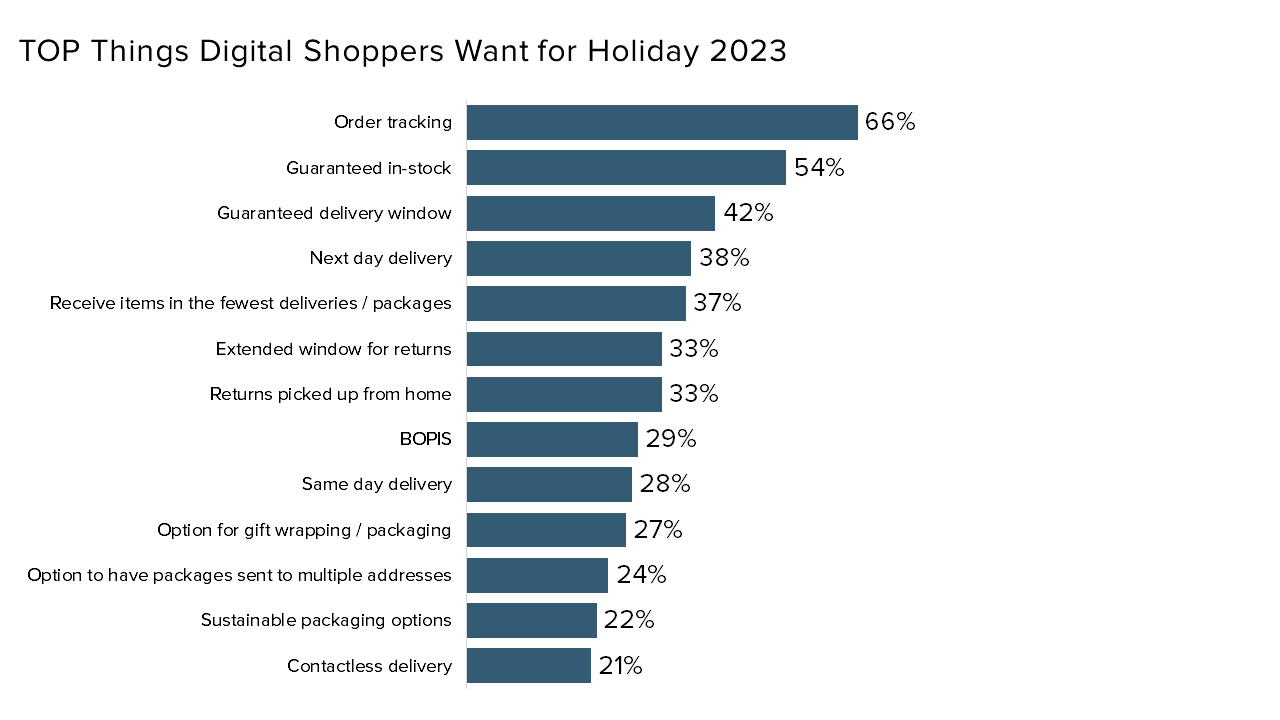

Looking ahead to 2023, digital shoppers will expect online retailers to provide order tracking, guaranteed in-stock inventory, fast delivery, and easy, lenient return policies — and they won’t be afraid to change tactics when these needs go unmet. Similarly, capitalizing on emergent trends will differentiate retailers from both in-store and online competitors.

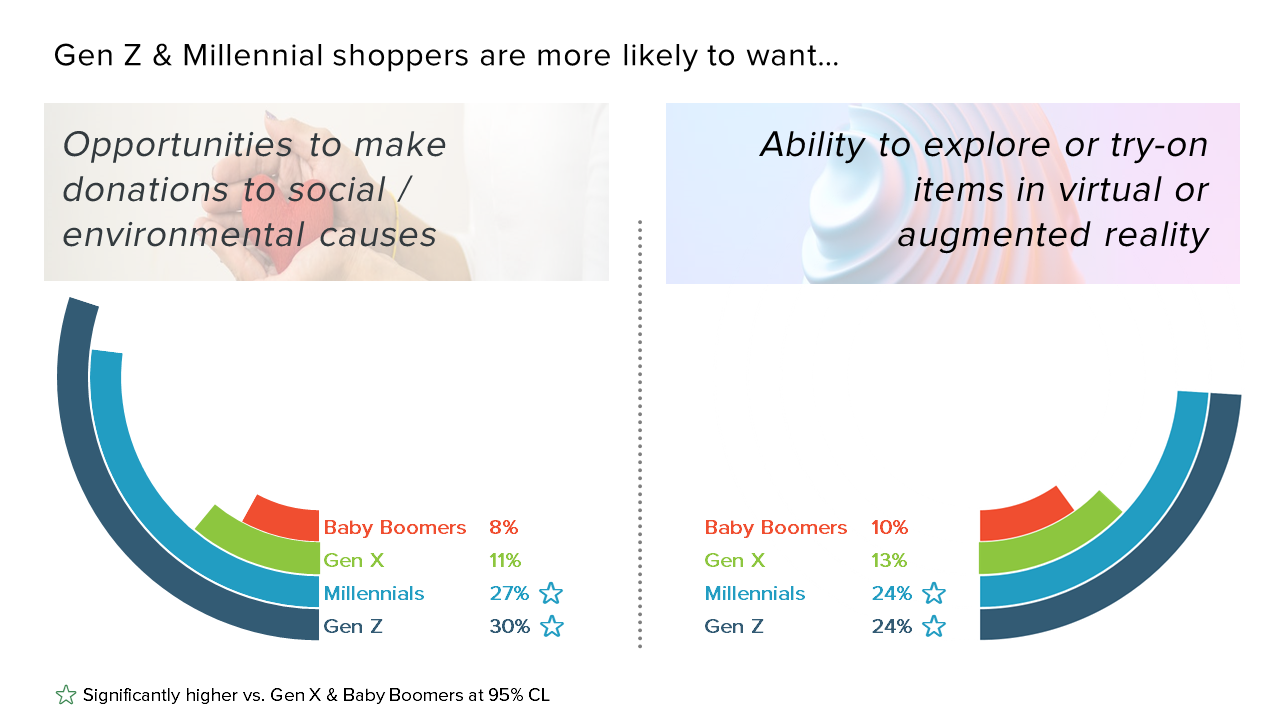

Brands and retailers can explore emerging interests as a way to engage with shoppers. Watch emerging trends in charitable giving and VR/AR experiences to appeal to younger shoppers. Over 20% of shoppers aged 18-24 indicated an interest in retailer-based charitable giving opportunities and 24% indicated interest in virtual activations such as virtual try-ons or VR-hosted events. Retail brand American Eagle, for example, hosted several virtual activations across platforms such as Snapchat, Roblox, and TikTok, encouraging Gen Z consumers to both spread holiday cheer while engaging virtually with the company’s products.

Despite the turbulence of last year’s holiday season, shoppers persisted in their effort to celebrate the season with gifts for themselves and others. And, as they started to step out of the shadow of the pandemic, we can find the digital shopper both online and in-store. This cross-channel shopping amplifies the need for retailers to keep a close eye on customer experiences both across channels and in emerging channels (e.g., shopping through links on social media).

Generating shopper delight during the holidays, and all year long for that matter, is as much about identifying potential pain points as it is about listening and responding in real time to the needs of your customer. To attract and retain customers in the next holiday shopping season, retailers and brands should look to address the prominent issues that arose this season, and incorporate desired experiences and offerings to delight shoppers. So, are you ready to strategize for the season ahead? Contact Reach3 to discover how you can leverage conversational insights to capture shopper feedback and experience throughout each step of the digital shopping journey.

To download the full report from Reach3, visit https://www.reach3insights.com/digital-seasonal-shopper-experience-2022