Our team at Reach3 Insights is passionate about understanding shoppers — it’s part of what we do. We’ve been tracking the evolution of shopping since the pandemic forced major changes to the way we think about shopping.

In the quickly evolving shopper landscape, understanding shopper journeys and motivations is of paramount importance to brands and retailers. With this in mind, we compiled a list of questions — from ourselves and from clients / insights professionals — and set out to explore some modern ‘phygital’ shopper behaviors and sentiments.

In this installment, we dive into the role of social commerce in shopper behavior, decisions, and as a vehicle for purchase. According to a report by Deloitte, social commerce is expected to reach approximately 2 TRILLION USD by 2025, growing by around 18% per year between 2021-25, with North America being one of its key growth regions. While younger generations are more attuned to shopping through social media, efforts by social media platforms to make them more user-friendly has resulted in a spillover to older generations as well, enabling its rapid growth, according to findings by eMarketer.

Leveraging our modern, conversational approach and Rival Tech, we engaged with American shoppers towards the end of 2023 to capture their in-the-moment sentiments and behaviors related to social commerce.

So what do brands and retailers need to know about shoppers and social media?

1. Shoppers want inspiration; social media has the answers!

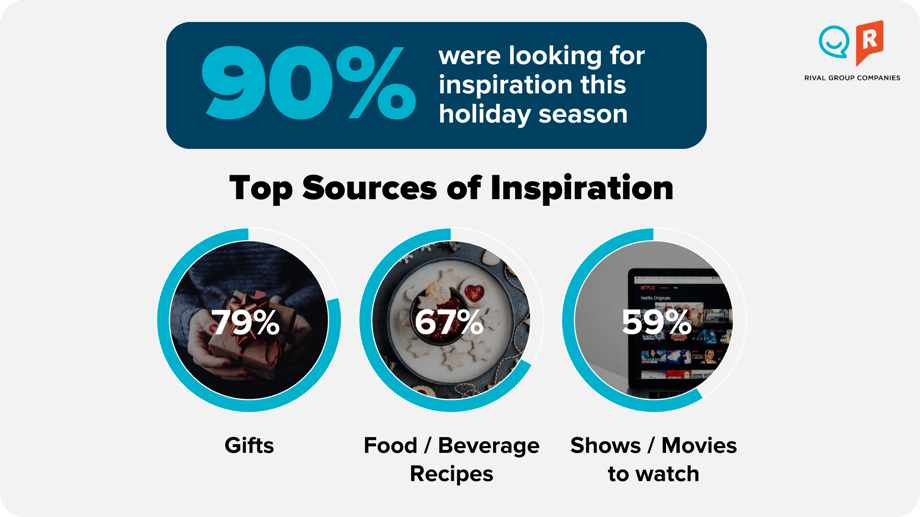

Throughout the holiday season, 90% of shoppers actively sought inspiration, particularly for gifting and culinary ideas. For these inspiration-seekers, social media was the primary source of inspiration with nearly three-quarters (72%), relying on it to drive inspiration during their journey.

What does that mean for brands/retailers?

By curating content that appeals to their audience’s interests and preferences, brands can use social media as a stepping stone to building familiarity, trust and loyalty. While 17% of shoppers ended up making a purchase via social media, 55% were open to the idea, indicative of a large untapped market and conversion opportunity for brands and retailers.

2. Shoppers aren’t actively looking to shop on social media, but can be swayed.

Even among those who ended up making a purchase on social media, most didn’t initially intend to buy something (only 9% came to social media with the intent of shopping). A majority of them were influenced by ads (79%) and posts (65%) they encountered.

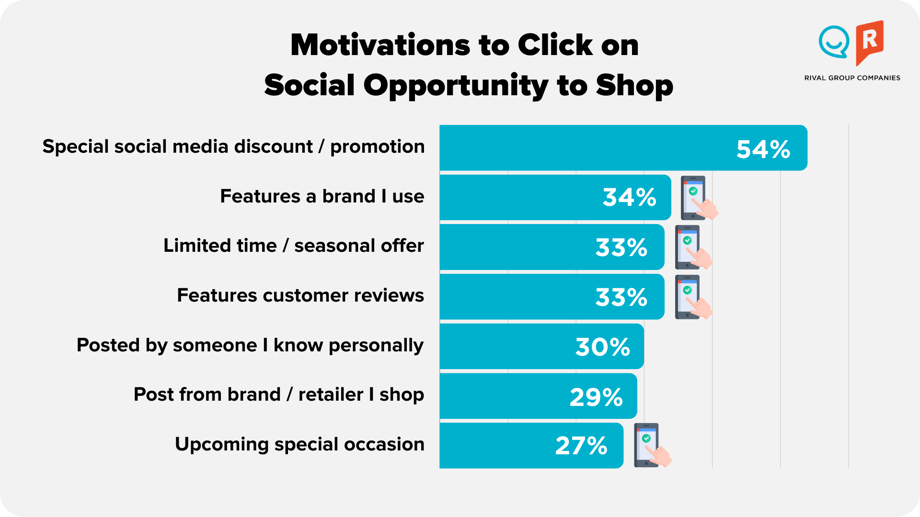

Motivational factors, such as discounts or promotions (54%) and visually appealing content (41%) have the ability to prompt action among shoppers, particularly when coupled with the allure of discovering new brands (56%) and the convenience of social media shopping (54%).

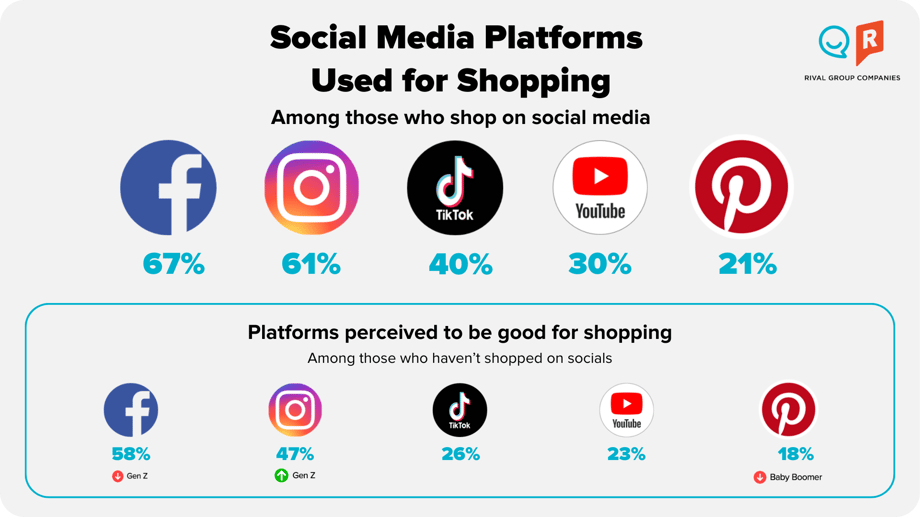

So, which platforms and categories might be most suitable for social commerce? Currently, Facebook and Instagram are the most top of mind platforms for shopping. Clothing, in particular, appears to be a category that shoppers would be comfortable buying on social. These platforms and the attire category represent the most accessible ‘paths’ into social commerce for brands; however, as social commerce continues to grow, we anticipate consumer openness to other platforms and categories to broaden, as well.

What does that mean for brands/retailers?

Social media can be a powerful tool for brands, engaging shoppers both in terms of discovery and conversion to purchase. Brands and retailers have a short window to capture attention of shoppers as they browse through social media. Diverting shopper attention towards their brand requires the use of targeted advertising strategies and compelling content to catalyze consumer engagement and drive conversion within the social media shopping landscape.

3. But converting shoppers is not easy, there’s a trust barrier to be overcome.

While appetite for social commerce does exist, significant barriers in the form of trust and privacy also exist. In the age of general mistrust on social media, shoppers are wary about giving out their credit card information (59% do not want to and 73% don’t know who gets access to it) to make purchases, driven in part by a lack of trust in the brand/retailer (60% say they don’t trust them, particularly among Gen Z).

What does that mean for brands/retailers?

Brands and retailers need to find ways to either facilitate alternate methods of payments for shoppers or implement mechanisms to assure shoppers that their information is safe and secure, (e.g., easily accessible and upfront information about data privacy). At the same time, social media platforms might explore ways to support brands and consumers with consistent, umbrella data privacy policies when it comes to shopping on their platforms.

So what do we take away from this all?

Social media is not going away any time soon; it’s a tool that is ubiquitous in our lives, and continues to be used for a multitude of purposes. When it comes to shopping, social commerce is evolving rapidly, representing an emerging touchpoint in the modern shopper journey. Brands will need to consider how shoppers leverage socials throughout their journey, from inspiration-seeking, to discovery and research, all the way through to ultimate purchase, in order to effectively engage with shoppers where they are.

Curious to learn more? Sign up to receive our future Phygital Shopper reports on this topic and more as they become available.