To keep up with evolving trends and consumer behaviors, companies need to employ the most innovative market research techniques available. Over-reliance on legacy technologies and methodologies is risky, not only because these often provide a subpar research experience but also because they deliver feedback that doesn’t completely reflect the true motivations, emotions and feelings of your customers.

Many of us at Reach3 come from decades of insights experience. As an organization, we believe it’s time to embrace modern methods that encourage people to share how they really feel and reach consumers where they’re most receptive to participate.

As you’ll see in the techniques highlighted below, the most exciting market research innovations in the next decade all leverage something that’s already in hand: the mobile device.

Mobile communities: Insight communities re-engineered for the mobile age

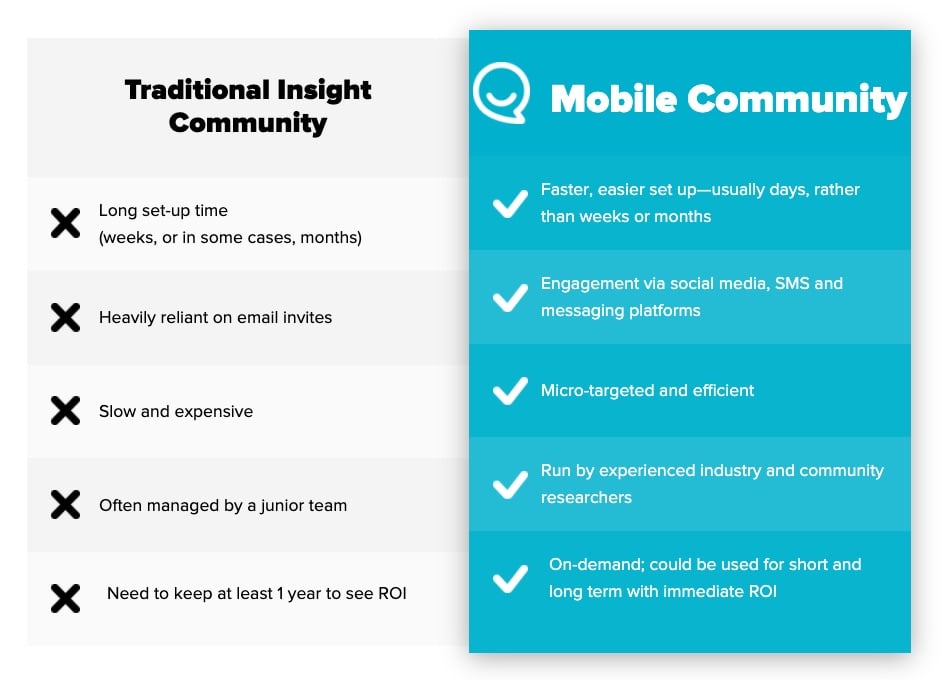

Many existing insight community platforms rely on older and outdated principles. For one, the traditional approach to insight communities leans on email, a channel that’s increasingly becoming cluttered. In 2020, 53.95% of email traffic was spam—an alarming stat that highlights why it’s getting harder to reach people through their inbox.

Besides using a channel that’s often ignored, email-based surveys also tend to be overly formal and clinical. You might be wondering why this is an issue. As Matt Kleinschmit, our CEO and founder, shared in an ebook, this old-school way of doing research inadvertently puts people in a “test-taking” mode where they put their guard up and don’t answer with honesty.

Unfortunately, community-based research has also developed a reputation for being expensive and difficult to manage. As a stopgap solution, some companies have a full-time employee whose main responsibilities are to manage incentives and do other community-related tasks.

There is a better—and a mobile-first—way. Mobile Communities are a mobile-messaging based solution purpose-built to help global brands capture the fast, iterative and ongoing insights they need to win in a rapidly changing world. Rather than relying on email, Mobile Communities engage members through a chat-like interface, reaching participants through channels they already use. This includes social media, SMS and mobile messaging platforms.

As you can see below, Mobile Communities are purposely set up to take advantage of the mobile tech’s most compelling features, while addressing the biggest disadvantages of traditional insight communities.

A growing number of global brands we work with use Mobile Communities both for short-term and ongoing projects. Check out our recent presentation with Diageo to learn how we’ve re-imagined community-based research for the mobile era.

Mobile notifications: In-the-moment customer feedback captured at scale

Here’s a question for you: If you want to reach a friend or a family member right now with an urgent question, would you email them… or would you text them?

If you’re like most people, you’ll likely text.

Text messages are powerful because they use mobile notifications, capturing the attention of the recipient in real-time and encouraging them to respond right away. On average, people respond to a text message within 90 seconds. In contrast, the average response time for email is 90 minutes.

When it comes to in-the-moment research, mobile notifications are useful in several ways. First, they allow you to get closer to the moment you’re trying to examine. Rather than hoping consumers recall their experiences, you can ping them as they’re doing the activity you’d like to ask about. If you’re doing missions, diary, in-home usage tests (IHUT) and other similar market research techniques, mobile notifications can open the door to deeper quantitative and qualitative insights.

When it comes to in-the-moment research, mobile notifications are useful in several ways. First, they allow you to get closer to the moment you’re trying to examine. Rather than hoping consumers recall their experiences, you can ping them as they’re doing the activity you’d like to ask about. If you’re doing missions, diary, in-home usage tests (IHUT) and other similar market research techniques, mobile notifications can open the door to deeper quantitative and qualitative insights.

If you’d like to see this approach in action, check out our award-winning work with Kimberly-Clark, where we leveraged mobile notifications in a multi-phased study around their online shopping experience.

Conversational research principles: A more human approach to asking questions

Ever notice how most market research surveys sound like a robot? (Here’s an easy example of what we mean: “One a scale of one to ten…”) Response rates for email-based surveys have been falling in the past decade, and the robotic and hilariously formal tone that the market research industry has become fond of is partly to blame.

As a next-gen market research consulting firm, we recognize it’s time for a more conversational approach. This means forgoing highly clinical language in favor of a friendlier and more human approach—one that echoes how people actually talk to their friends and family.

If your survey sounds like a survey, you need to rewrite it.

It’s really all about looking at the world of mobile messaging and creating a similar experience. One thing we like to say internally is if your survey sounds like a survey, you need to rewrite it. To reflect this conversational approach, we don’t even refer to our conversational surveys as surveys—we call them chats!

If you’ve ever gotten a long text message, you’d know why we also discourage long paragraphs. Your customers don't expect (or want) a long wall of text they would have to scroll through on mobile to answer your question.

Why is this conversational approach such an innovative market market research technique? Besides encouraging people to open up, it provides a vastly improved respondent experience. The result is an increase in response rates and ongoing participation in your Mobile Community.

Visuals: Leveraging multi-media to extract more depth and richness

Here’s something you may not have thought of yet: using GIFs, emojis, memes and other images to capture deeper insights.

A quick example should demonstrate what we mean. In a recent research study on video conferencing, we wanted to know how people really felt about video chats. Instead of directly asking participants about it, we first asked them to select from a gallery of GIFs which one best represented their feelings. We then followed up by asking why they chose that GIF and to share a story or a video that illustrates their choice.

A quick example should demonstrate what we mean. In a recent research study on video conferencing, we wanted to know how people really felt about video chats. Instead of directly asking participants about it, we first asked them to select from a gallery of GIFs which one best represented their feelings. We then followed up by asking why they chose that GIF and to share a story or a video that illustrates their choice.

Compared to the traditional approach, this visual emotional elicitation exercise enabled us to get very detailed anecdotes. Many of the stories submitted by research participants (many of whom were Gen Zs) were funny and embarrassing—which we didn’t expect. The candid and detailed stories we got provided a richer and more nuanced understanding of people’s frustrations about video conferencing.

If you’re like most people, you likely already use memes, GIFs and emojis in your daily interactions. So why not use these in market research as well?

Worried consumers may think emojis are unprofessional? Don’t be—one study found 76% of people used emojis in their professional communications.

Quant and qual integrated: Getting deeper insights in a single seamless and mobile-first experience

In the past, the typical market research approach was to collect quantitative and qualitative feedback separately in sequential phases. One reason for this: issues with legacy insight platforms. Most had the tendency to favor one methodology over the other.

Mobile technology and consumer expectations have changed all that. Today, the capabilities of mobile devices make it easy to capture robust quantitative data and rich qualitative inputs in a single, seamless experience. Rather than sending a survey to conduct a quant study and then asking respondents to submit videos using another market research platform, you can capture all of that in one activity.

The capabilities of mobile devices make it easy to capture robust quantitative data and rich qualitative inputs in a single, seamless experience.

To be clear, we’re not advocating for long, tedious surveys. The respondent experience needs to come first. Mobile notifications, which we’ve discussed earlier, can be used to re-contact research participants for follow-up activities—an iterative approach that allows you to capture rich insights over time without relying on a single 20-minute survey.

Combining the best of quant and qual delivers incredible business ROI. In a recent study for a fast-moving consumer goods company, we gathered a deeper understanding of the motivations influencing consumer’s evolving breakfast behaviors after using a mix of quantitative inputs and video-based answers from research participants.

Innovative market research techniques give you deeper insights

Working with global brands has shown us time and time again that a conversational, mobile messaging-based approach studies deliver richer qual and quant insights. Thanks to the mobile device, it's now possible to capture behaviors, emotions and context in one single research touchpoint.

Explore The Future of Insights is Conversational to learn more.