There is significant opportunity to innovate in a way that addresses the unmet needs of DE&I “harder-to-reach” audiences.

How can financial services companies be reimagined to stay relevant among “harder-to-reach” audiences?

Gen Z, Millennials, and traditionally “under-represented” consumers (e.g., Hispanic, African American, Asian American, LGBTQ+, the Underbanked/Unbanked) have enormous buying power. In looking at growth between 2010 and 2020, according to the Multicultural Economy report by the Terry College of Business Selig Center, Asian American buying power grew by 111%; the buying power for those of Hispanic ethnicity grew by 87%, and African American buying power grew by 61%. Yet, they are often left out of the research large enterprises use to drive innovation due to the fact that are often not found on traditional research panels, and they typically eschew commonly used online email surveys.

To help financial institutions with insights that can help inform their DE&I strategy and tactics, we recently used our conversational techniques and Rival Technologies’ mobile messaging-based market research platform to chat with “harder-to-reach” consumers about their expectations for the future of Banks, Payment Providers, Insurers, and Investment Management Firms.

Here is what we uncovered…

Not every sector of the Financial Services Industry is viewed equally

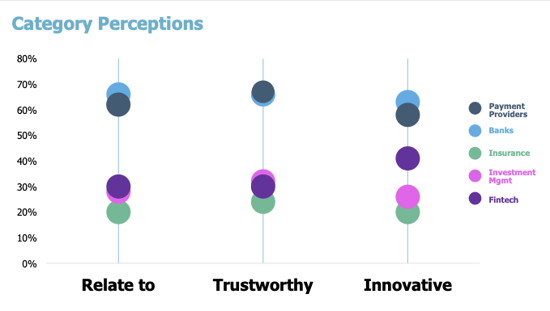

Looking specifically at relatability, 66% of harder-to-reach audiences name Payment Providers as being most relatable, followed by Banks at 62%, Fintech at 30%, Investment Management at 28% and Insurance at 20%.

The story is a little different with innovation, with 41% naming Fintechs as most innovative, putting them well ahead of Investment Management (26%) and Insurance (20%), but still lagging behind Payment Providers (63%) and Banks (58%).

Reach3 Proprietary Research: Future of Financial Services –May 2022 | Base: Total (n=945) Q12b. When it comes to your financial well-being, which brands do you relate to the most? Q12c. Which brands do you feel are most trustworthy when it comes to financial services? Q12d. Still thinking in the context of financial services, which brands do you think are most innovative?

The future of retail banking needs to be reimagined to stay relevant for younger generations

As harder-to-reach audiences cast their eyes to what Financial Services will look like in 5 years, 54% expect to interact less with real people for their financial transactions and more with digital tools, driven by Asian Americans (at 70%) and the Underbanked (at 62%), compared to just 43% of Boomer+.

Indeed, 30% go so far as to say that traditional banks will disappear in the next 10 years with the Underbanked (51%), Gen Z (43%) and LGBTQ+ (40%) leading that thinking. This has tremendous implications for the future of retail banking and demands a reimagining of how to stay relevant for future generations.

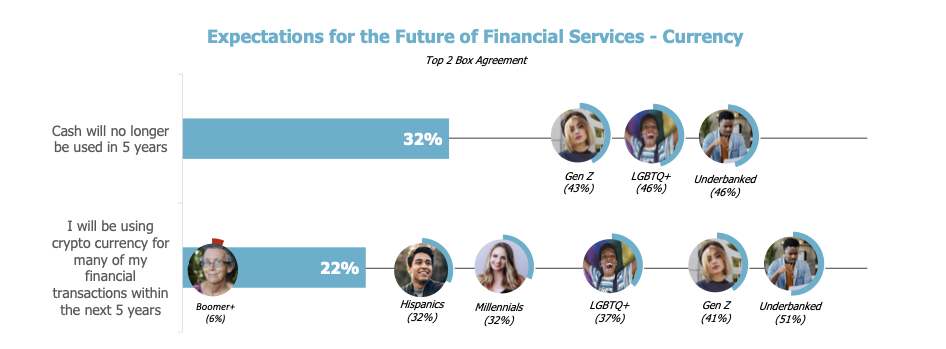

Cash will still be king, crypto is on the rise

While “harder-to-reach" audiences may expect to see a decline in traditional banking, they believe cash will still be king; only 32% expect that cash will no longer be used in 5 years. However, for LGBTQ+ that expectation climbs to 46%.

We see a similar trend for usage of crypto, with only 22% believing that they will be using crypto currency for many of their financial transactions within the next 5 years, but with the underbanked and Gen Z predicting much higher usage of 51% and 41%, respectively.

Reach3 Proprietary Research: Future of Financial Services –May 2022 Base: Hispanic (n=111); LGBTQ+ (n=132); Unbanked (n=94); Underbanked (n=219); Gen Z (n=111); Millennial (n=342) Q13. And, looking at the following statements, how much do you agree with the following? Groups shown skews significantly higher vs. Total at 95% CL.

Social responsibility is here to stay in Insurance and Investment Management

Outside of banking, consumers are expecting to see changes in investing and insurance. 58% agree that socially responsible investing will be more important within the next 5 years, driven by 75% of the underbanked and 70% of LGBTQ+.

A similar number, 59%, agree that socially responsible insurance will be more important within the next 5 years, driven by 72% of LGBTQ+ and 69% of Hispanics. These expectations can help provide an innovation roadmap for investment management and insurance companies.

The innovation opportunity

Harder-to-reach audiences are a key growth driver for both established as well as new financial services products. For example, 44% say they would be likely to use digital banking in the future, driven by LGBTQ+ (67%) and Gen Z (62%). With investment apps, 34% are likely to use them in the future, driven by Millennials (48%) and Hispanics (47%).

There is significant opportunity to innovate in a way that addresses the unmet needs of DE&I “harder-to-reach” audiences. To realize this, financial services firms need to leverage conversational research principles to uncover what people actually think, feel and do, through the channels that they themselves already use.

Doing so will help these enterprises foster acceptance and tolerance within their organizations, and build empathy and understanding to help improve the financial well-being of communities that have historically been marginalized.

To learn more about The Future of Financial Services from the perspective of DE&I “Harder-to-Reach” audiences, download our full report.

Siddharth Gopinath

SVP, Financial Services

.webp?width=65&height=83&name=A-LIGN_HIPAA%20(1).webp)