Ironically, as consumers have embraced more digital and mobile financial services, they still crave the personal touch.

“Who needs another research supplier?”

“We’re managing fine as it is, thank you very much!”

As the new leader of Reach3’s Financial Services practice, I was prepared for these types of reactions as I reached out to prospective clients. After all, who’s got the time to listen to yet another pitch and go through the hassle of onboarding a new market research supplier?

Luckily, the reaction I got was quite the opposite. In fact, (dare I say), there has been a palpable sense of excitement about how we can help with research and business challenges in financial services.

Here are the top 3 unmet needs that have come up.

1. We struggle to connect with Gen Z and “under-represented” audiences.

The fact of the matter is that Gen Z and “under-represented” (e.g., Hispanic, African American, Asian American, LGBTQ, Underbanked, Unbanked) audiences are hard to reach—they often are not found on traditional research panels, and they typically eschew commonly used email surveys.

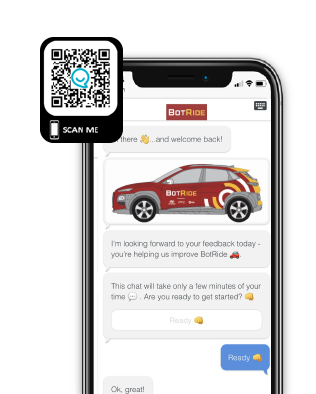

Reach3 has created an entirely new research experience using a device that most people have at their fingertips—their smartphones—to conduct conversational, mobile "chat surveys." Powered by Rival Technologies, the world's best mobile market research platform, these conversational exercises mimic the look and feel of mobile messaging services. They eliminate the clinical and robotic experience of a traditional test-like email survey. Instead, our research techniques are more organic, immersive, and natural—with participants providing stream-of-consciousness feedback.

Reach3 has created an entirely new research experience using a device that most people have at their fingertips—their smartphones—to conduct conversational, mobile "chat surveys." Powered by Rival Technologies, the world's best mobile market research platform, these conversational exercises mimic the look and feel of mobile messaging services. They eliminate the clinical and robotic experience of a traditional test-like email survey. Instead, our research techniques are more organic, immersive, and natural—with participants providing stream-of-consciousness feedback.

And, since there is no app to download, our insight platform allows us to naturally chat with audiences where they already hang out, such as their existing social media platforms.

2. In the world of increasing digitization, we need to develop intimacy and empathy.

Ironically, as consumers have embraced more digital and mobile financial services, they still crave the personal touch. The need for a live presence has not gone away, but it is being reimagined. Several financial institutions are experimenting with different retail and remote formats focused on new offerings around advisory services and financial well-being. Some are trying to leverage grass-roots sponsorships and activities to create a local feel.

Wouldn’t it be ideal to speak to an individual during or right after a specific experience without the typical pitfalls of engaging in a jarring “intercept,” relying on what they recalled some days ago, or putting them in an artificially created environment?

At Reach3, we are able to conduct in-the-moment research at scale and leverage the immediacy of messaging-based activities to understand behavior and emotion at source. We leverage QR codes to engage people on-site or on-screen and capture their experience through a variety of means, including video selfies, photos, and observational footage. These video-based techniques help to illuminate the customer experience and build empathy within client teams.

At Reach3, we are able to conduct in-the-moment research at scale and leverage the immediacy of messaging-based activities to understand behavior and emotion at source. We leverage QR codes to engage people on-site or on-screen and capture their experience through a variety of means, including video selfies, photos, and observational footage. These video-based techniques help to illuminate the customer experience and build empathy within client teams.

3. We need an effective way to engage with my B2B target.

B2B audiences are notoriously difficult to recruit and engage with given their busy schedules and lower motivation to participate in research. This challenge applies equally to small or medium-size business owners, financial advisors, insurance brokers and more.

However, the need to understand them has grown even more urgent since their businesses have been transformed, not only by COVID, but by the ongoing disruption brought about by the digitization of their work environments and the technological advances sweeping across the financial services landscape.

We generate strong recontact rates of up to 60%, making it possible to engage in longer-term B2B communities at scale.

We have seen that our mobile and agile research approach provides the type of ease and flexibility that facilitates B2B recruiting and engagement. In fact, we generate strong recontact rates of up to 60%, making it possible to engage in longer-term B2B communities at scale. To increase stickiness, we set up a chat “persona” UI that is customized to the organization’s personality and tone. While a consumer audience takes to video-selfies with ease, we find that this B2B audience is comfortable with talk to text as a way to add depth and richness.

This is just the tip of the iceberg regarding the benefits that Reach3’s mobile messaging-based insight solution offers.

So, back to the original question: “Do you really need another research supplier”? Reach out to us for a call; your answer may surprise you.

Siddharth Gopinath

SVP, Financial Services

.webp?width=65&height=83&name=A-LIGN_HIPAA%20(1).webp)