The appeal of signing up for a subscription service comes down to the excitement of getting a fun surprise with new and unique products; ultimately it's a 'special treat' to yourself.

Whatever you’re into, there’s most likely a subscription box service for it.

From pet supplies to underwear, from meat products to a “get pregnant bundle,” the subscription service industry has expanded far beyond just beauty samples and meal kits. Once dominated by online-only, direct-to-consumer companies, big brands such as Nike, Disney and Macy’s are jumping on this trend by introducing their own subscription offerings. In 2018 alone, investors put in more than $1.2 billion in capital in this space.

But this market is not for the faint of heart. As apparent from Blue Apron’s dwindling stock price or the bankruptcy of subscription-box startups like Loot Crate, success requires a long-term strategy to convert customers from “trial” to loyalty.

Here at Reach3, the rise of direct-to-consumer sales and subscription services is a key business challenge we find ourselves regularly discussing with clients. Given the industry’s widespread impact, we were inspired to gather our own insights on the subscription service industry. This summer, we developed a conversational research approach with the goal of better understanding the motivations and barriers to signing up for subscription services, and the trends that will shape the future of this space. Using software from our sister company, Rival Technologies, we engaged more than 1,000 consumers via a conversational messenger-based survey (or “chat”, as we like to call it). This unique methodology allowed us to not only conduct robust quantitative analysis (including a MaxDiff), but also gather rich qualitative feedback from consumers like photos and video uploads, as well as a projective emotional elicitation exercise.

Over the course of the next few weeks, we’ll share our in-depth analysis and key insights in a series of article. If this content piques your interest, make sure to subscribe to our blog to get notified of new subscription service content.

Without further ado, here are 3 of our biggest takeaways from the research (and yes, we have a thing with “3” here at Reach3 😃).

1. Consumers want surprises in the mail, not their bank accounts

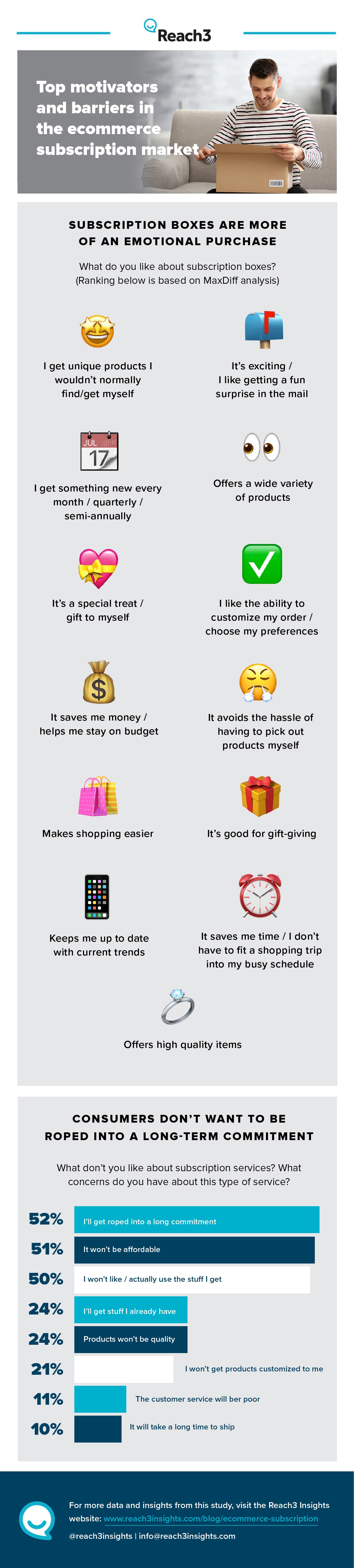

When we analyzed people’s motivations for signing up for a subscription service, it became very clear that emotions, not logic, are what drive subscriptions.

The appeal of signing up for a subscription service comes down to the excitement of getting a fun surprise with new and unique products; ultimately it's a 'special treat' to yourself. On the flip side, we were surprised to see that more logical reasons to try subscription services — including the ability to save money, get quality items and avoid the hassle of picking out items yourself — were less persuasive to consumers.

When you think about the current digital age, it’s interesting that there’s still something captivating about physically getting mail and the excitement of seeing what it is. Knowing that consumers are leading with their emotions has major implications for subscription brands as they develop marketing communications and messaging to reach consumers.

However, we do see some risks associated with marketers leaning too heavily into communicating “excitement” and “surprise” and forgoing the more functional aspects of subscription services. When it comes to barriers to signing up for subscription services, three reasons were cited by over 50% of consumers: long commitments, high cost and risk. Simply put, many consumers told us they see subscription services as “fun but risky” since you never know what you’ll get, and many mentioned subscription boxes can make you feel “trapped” because they’re hard to get out of.

As such, clear communication and flexibility are crucial. Companies will be able to convert more people if they make it clear that their customers won’t be tricked into long-term commitments or into buying things they don’t want. However, it’s a delicate balance between emphasizing the fun excitement of getting a surprise in the mail, while still reassuring that there’s safeguards in place if you don’t like what you get.

2. Smaller, direct-to-consumer brands currently have the edge

As I mentioned above, big brands are very keen to make their mark in this space. But we found that smaller companies that specialize solely in subscription services currently have the edge. These direct-to-consumer brands tend to have the most awareness and usage in their respective categories.

So why are subscription-only companies dominating their categories? Our hypothesis is that in addition to the obvious first-mover advantage, these brands are more nimble; they have the ability to control every touchpoint of the customer journey, in a way a big conglomerate can’t. Another possible reason has to do with legacy: at this point, consumers simply do not associate the subscription-box market with bigger, more established companies.

In any case, big brands that want to make their mark need to invest in marketing and insights to better understand the space and uncover opportunities for growth – i.e. what is their niche, value-add or differentiation in this space? Without one of these 3 things, consumers are likely to stick with the original direct to consumer brands.

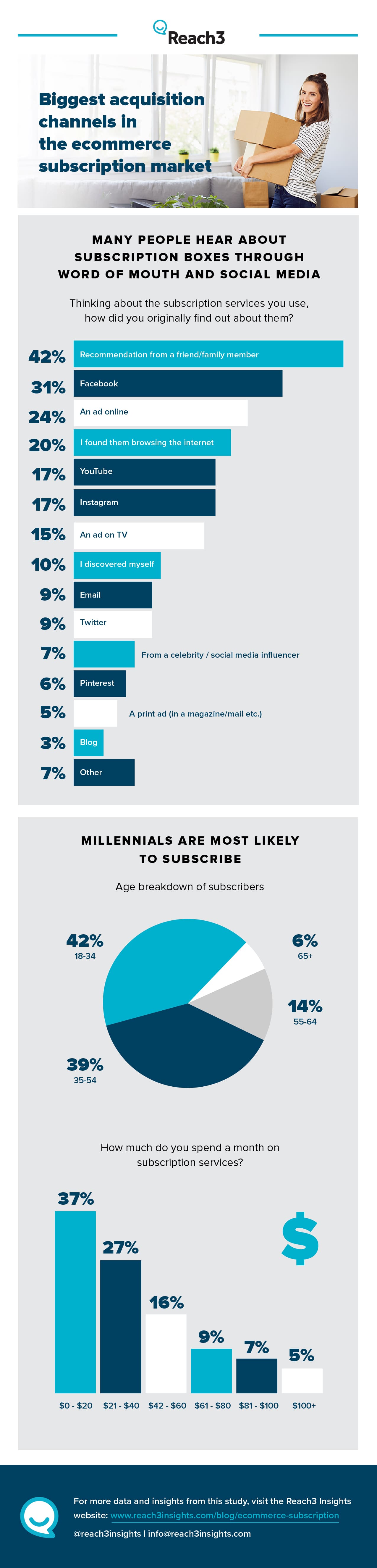

3. Word of mouth and social media are big acquisition channels — but influencer marketing is not

We asked people how they originally learned about subscription services. Not surprisingly, word of mouth came out on top: 42% said they heard of a service via a recommendation from a friend or a family member.

Many people also hear about subscription services via social media (Facebook, YouTube, and Instagram, in particular) and online ads. Interestingly, only 7% of the consumers we engage with said they’ve heard of a subscription via celebrities or online influencers.

That last finding is interesting given how many subscription box services invest in influencer partnerships. (For example, Ipsy, a makeup bag subscription box service, recently enlisted influencers to create videos that featured the company’s products.) Influencer marketing isn’t necessarily ineffective — however, our findings indicate this form of advertising may warrant further investigation as your marketing dollars could possibly be working harder for you in other channels.

Questions about the ecommerce subscription market?

As I mentioned above, there’s a lot to unpack here, and we will be revealing more over the next few weeks.

In fact, since we feel that we’ve only scratched the surface, we are planning on doing a series of follow up chats to continue to engage with consumers and build a deeper understanding of their thoughts and feelings related to subscription boxes. In our previous study, 80% of consumers we chatted with agreed to participate again — a testament to the engaging nature of Reach3’s conversational approaches! As a result, we have an organic digital community of consumers ready to continue to share their thoughts on this topic.

If you have questions about this market that you’d like us to include in a future study, please send them through this short and fun chat.

Mackenzie Hollister

Sr Research Consultant, Reach3 Insights

.webp?width=65&height=83&name=A-LIGN_HIPAA%20(1).webp)