It’s important to remember that these innovations are just the beginning; there are still plenty of whitespace opportunities to create billion-dollar industries.

In 2018, a report by the Global Wellness Institute found that the global wellness economy was worth $4.5 trillion USD, growing at an average of 6.5%—nearly twice as fast as the global economy. As health and wellness technologies integrate with our routines and habits, they are gathering an unprecedented amount of data about our daily lives—over 335 petabytes per month to be exact. Nearly every brand and organization that has a stake in the health and wellness industry—insurance companies, CPGs, pharmacies, tech start-ups, and healthcare providers to name a few—are racing to leverage this wealth of data.

To help brands understand the emerging attitudes, expectations, and points of friction in this growing space, Reach3 recently hosted Digital Health & Wellness in the Age of Quarantine, a live webinar featuring Jeremiah Owyang, Technology Analyst and Founder of Kaleido Insights, and Matt Kleinschmit, CEO and Founder of Reach3 Insights. Moderated by Andrew Reid, the webinar featured key findings from the foundational wave of our ongoing syndicated research program, TrendSpot: Digital Health & Wellness.

A recording of the webinar is now available. Here’s a few key takeaways:

1. There are still plenty of billion-dollar opportunities for brands interested in entering the market

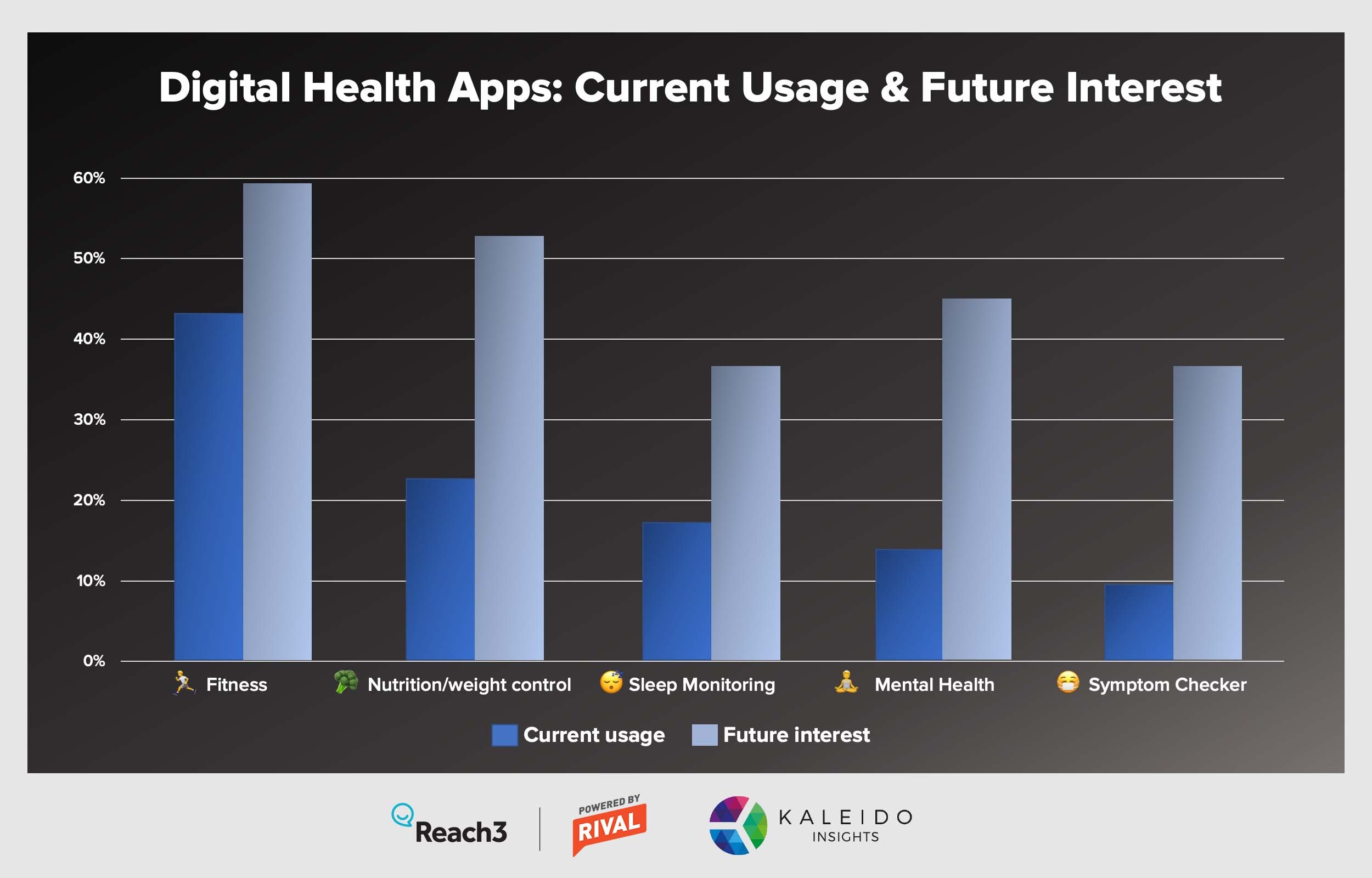

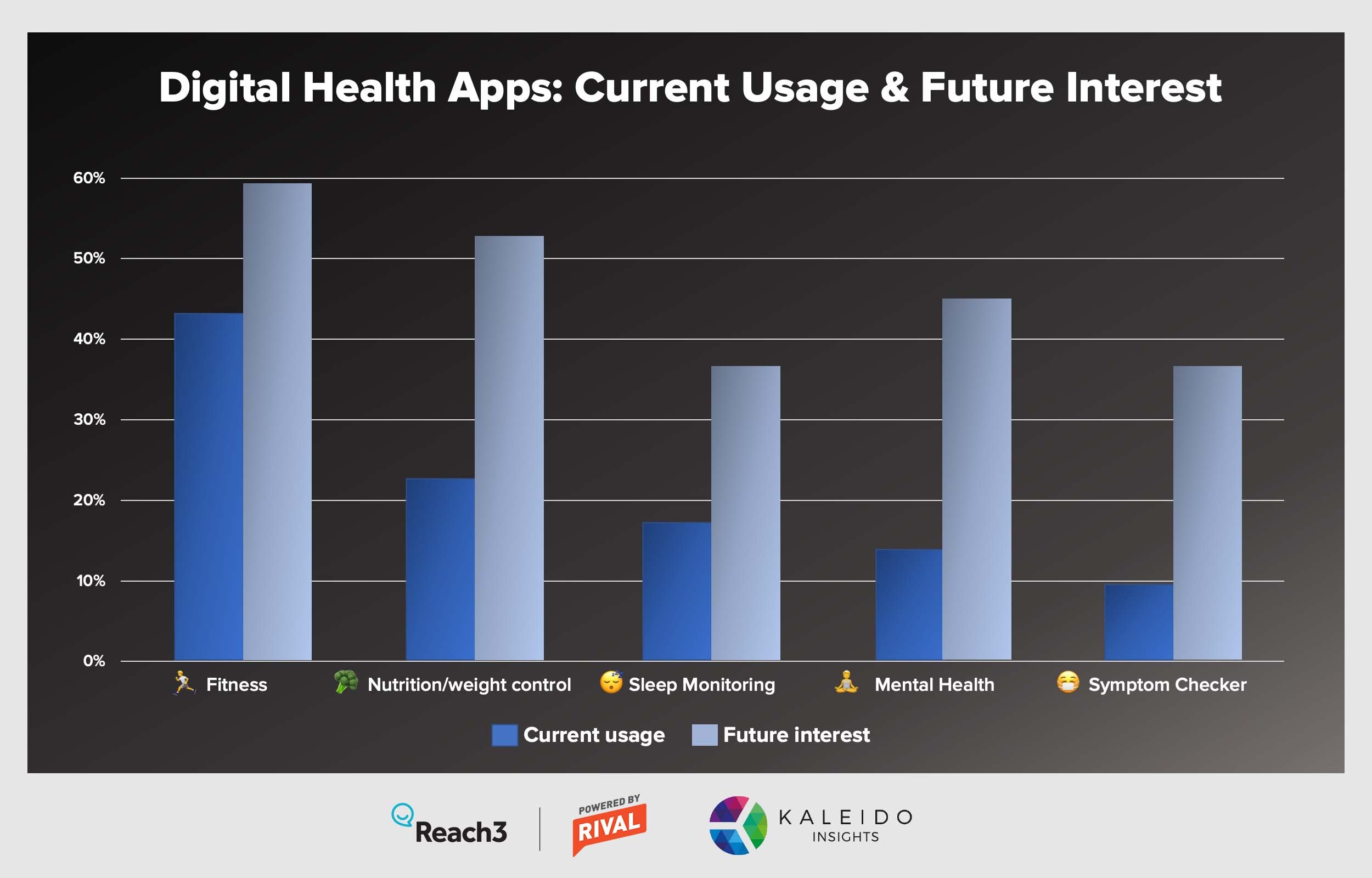

According to our research, 39% of Americans are interested in adopting health-related devices and 32% in adopting health-related apps. Fitness and nutrition-oriented devices and wearables made the top of the list, followed by sleep monitoring systems, mental health trackers, and other smart devices, like scales and watches.

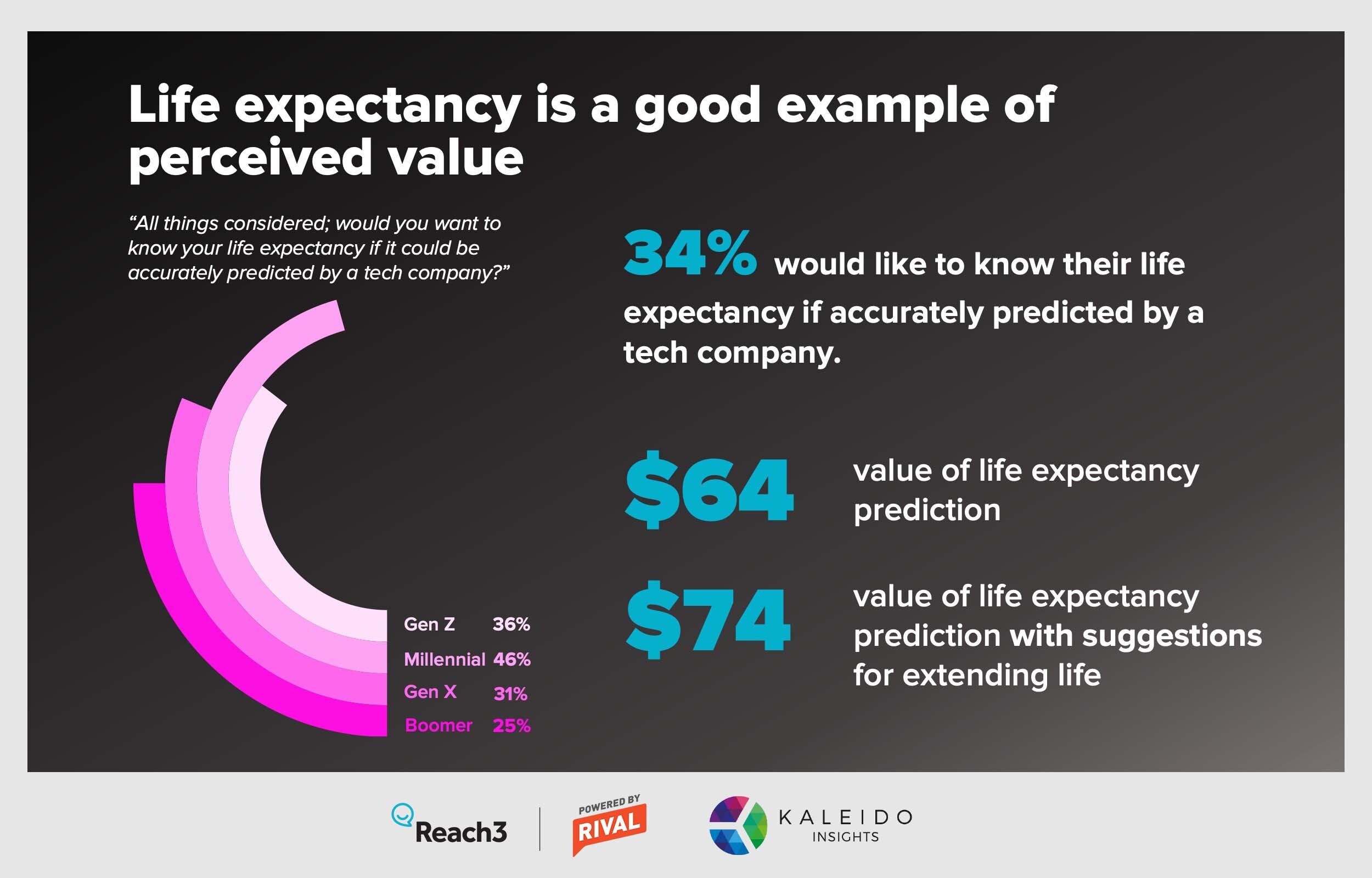

These innovations are just the beginning; brands have plenty of opportunities to create billion-dollar industries. For example, 34% of consumers would like to know their life expectancy if accurately predicted by a tech company. So, what does this mean for your brand? The speakers said getting ongoing customer insights to track unmet needs will be key.

“Digital health and wellness is dynamically evolving,” Matt reiterated. “It will require new tools to keep a finger on the pulse of how these perceptions and behaviors are changing rapidly-evolving perceptions and needs.”

2. Consumer trust is non-negotiable for all companies—especially Big Tech

More than half of Americans say they would never trust a Big Tech company with their personal health data. However, 59% of people also say that control over their personal health data would increase their trust in the organization holding their data. As a result, brands need to gauge their relationship with consumers to understand the perceived level of trust prior to introducing any new health and wellness technologies or services.

As part of the research, we asked people to rate their level of trust with various health and wellness-related organizations, such as a family doctor, start-up tech companies, health insurance companies, and the government. People trust traditional health organizations with their health data, feeling the most comfortable with doctors, who they likely don’t view as a business. This trust, however, doesn’t extend to most Big Tech companies that are new to or have recently entered the health and wellness space, such as Meta (formerly known as Facebook).

Earning consumer trust won’t happen overnight, but the speakers said, forging the right partnerships could help tech companies bridge the trust gap in the short-term. Big Tech companies have the opportunity to partner with traditionally well-trusted health organizations as a way to quickly earn consumer trust. In return, these healthcare organizations could provide a greater range of tech services or products to their patients.

3. Life-expectancy tech is gaining traction

Most people have asked themselves the age-old question, “how long are we going to live?” We posted a similar, more tech-oriented version of the question to our participants with some interesting results:

“All things considered; would you want to know your life expectancy if it could be accurately predicted by a tech company?”

Of the people we asked, 34% would like to know their life expectancy if accurately predicted by a tech company. When asked about what they would consider a reasonable amount to pay for such services, the average value came out to $64. Interestingly, this perceived value only increased to $74 if the services included suggestions or recommendations for extending life.

“This data point was shocking to me,” Jeremiah admitted, adding that consumers probably aren’t willing to pay more for recommendations since most people already know what they need to do to increase their life expectancy.

Millennials are more open to life expectancy knowledge; however, under half of this age cohort are interested. Americans generally have positive feelings about the idea of knowing their life expectancy—many feel it could help them escape the overall uncertainty of life.

4. Each consumer group is different. Use it to your advantage

Age, gender, and income all play significant roles in predicting what digital health and wellness trends consumers will be most interested in purchasing or adopting. For example, Gen Zs and Millennials have a greater interest in mental health (26-30%) and brain health technologies (27-35%), whereas Gen Xs and Boomers are more interested in nutrition (34-35%) and weight management devices like smart scales (25-26%).

“Different demographics and subgroups have big swings in interest, appeal and behaviours,” Matt explained. “Understanding nuance in value drivers is going to be really critical for potential new entrants and companies thinking of new product offerings and services.”

Getting customer insights on these trends need to be an ongoing exercise as things change in the consumer landscape. During COVID, for example, we’ve seen massive shifts in attitudes, sentiments and behaviors as people have gone through different waves of lockdowns face the threat of new variants.

Matt added, “To actively meet the needs of different consumer groups, brands really need to keep a finger on the pulse these fast-evolving sentiments and expectations — really understanding those value drivers for specific audiences and how they are evolving and changing over time.”

Programs like TrendSpot: Digital Health and Wellness are designed to help companies track changes in the market. Using mobile-based market research tools and methodologies to connect with your consumers in the moment can also help you get the quantitative and qualitative data you need to understand the underlying factors driving changes in the market.

*****

The findings in this article are only a small sample of the research collected as a part of our larger ongoing TrendSpot: Digital Health & Wellness program. For more information, watch our webinar Digital Health & Wellness in the Age of Quarantine.

Natalie Korz

Content Marketing Specialist

.webp?width=65&height=83&name=A-LIGN_HIPAA%20(1).webp)