When asked how AI could be used in financial services, consumers suggest human interventions such as chatbots for customer service, streamlining call centers, and providing financial advice.

According to the U.S. Bureau of Economic Analysis, Americans in 2023 have been setting aside only 3.9% of their disposable income for savings, compared with an average of 8.5% over the past decade. This is just one example of how the landscape of personal finances has changed in the last decade.

Take that singular data-point and factor in Gen-Z attitudes towards traditional financial services, a slowing economy and wildly unpredictable markets the financial sector is facing new and unforeseen challenges. The question we wanted to understand is how does AI fit into this matrix and, as conditions continue to change, how can AI help assess trends, help people and banks pivot as needed and find new ways to help people from all generations make better financial decisions?

What do people know? While familiarity with AI in general is high, Americans are much less aware of how financial companies are using AI today

While many American consumers, especially Gen Z, are becoming more aware of AI overall, fewer (46%) are aware that banks or other financial companies are using AI in consumer-facing products and services. Gen Z is least aware of AI's role in consumer finance (36%), an interesting turnabout that the group most familiar with AI is the least familiar with it being used for banking and finance.

When asked how AI could be used in financial services, consumers suggest human interventions such as chatbots for customer service, streamlining call centers, and providing financial advice. That covers common customer interactions, but what about the ‘behind the scenes’ aspect? Across all age groups, awareness is lower surrounding back-of-house usages of AI like cybersecurity and fraud detection.

“Maybe financial services could use AI by having it do more work other than calculations, like maybe customer support and giving a lot more options in that area.”—Male, Gen Z

“I think that banks and other financial companies could use AI in the future by allowing basic transactions and common customer service questions to be tackled by AI. Questions that are more complex with rules and regulations can reach a human assistant.”—Male, Millennial

Today, consumers are not choosing a financial company or service based on its use of AI, but consideration increases the more they learn about AI

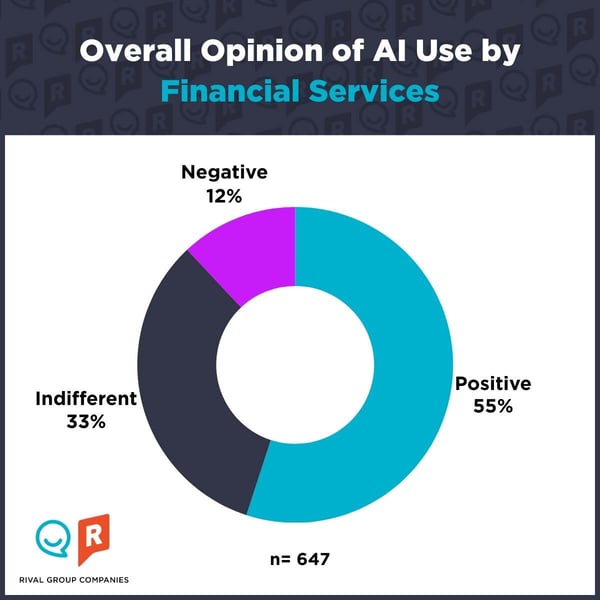

Overall, just over half (55%) of consumers are positive about the use of AI by financial companies, with no difference in sentiment among age cohorts.

Reactions typically fall into one of four different groups: optimism, skepticism, caution, and uncertainty. Let’s dig into each of those below.

Consumers are optimistic about the use of AI in banking and financial services, with many conceding that AI is faster and less error-prone than a human may be. They feel that by using AI, banks and financial institutions can become more efficient by freeing up human workers for more complex tasks.

“AI can make things efficient and cut out the workload of easy tasks so humans can concentrate on the more difficult things.”—Female, Gen X

“I think that it can make the financial world way more efficient and reliable. I like it because efficiency is a major factor in business.”—Male, Millennial

Others are skeptical about the idea, recognizing there are potential benefits but aren’t completely comfortable or trusting of how it might work in the financial world.

“I'm not really comfortable with financial companies using AI right now. I may be more comfortable in the future.”—Male, Millennial

Plenty of consumers are cautious, pointing out that AI could make decisions that aren’t in the best interests of someone’s individual finances.

"I don't like it, I don't trust AI and I don't like how banks are cutting corners using AI, so they don't have to pay actual people to do the same work."—Female, Millennial

“I don’t love it because things can get messed up when using technology, and I like to know that real humans are doing services.”—Female, Gen Z

“AI is everywhere. If a company is not using it, they will be out of business. However, they need to be responsible with the information they acquire and protect their customers.”—Male, Gen X

“I think that using AI for SOME services in a financial institution would be okay, but not for all. AI can’t get to know a person's situation and sympathize or understand a situation. Tech has bugs, I'd hate for my finances to be messed up because a computer was in charge of it.”—Female, Millennial

And finally, there are consumers who are just uncertain about the whole topic of AI. They take a more “wait and see” approach, recognizing there are benefits, but at what cost?

“I think it could be useful, but I would have to know more about how it is being used before making a final decision.”—Male, Gen X

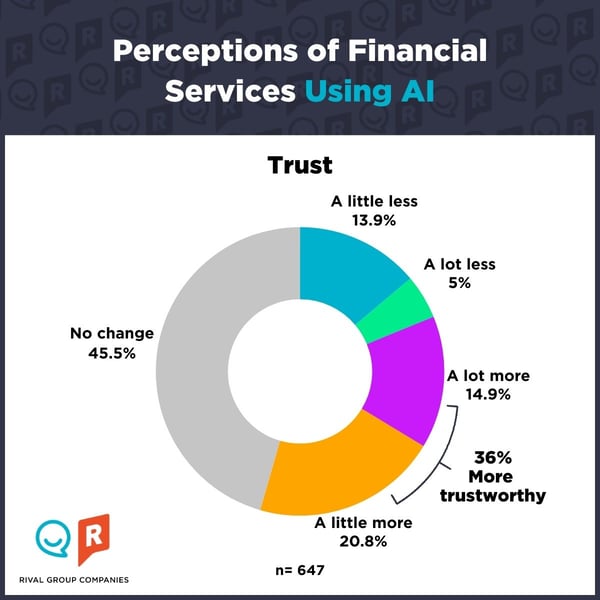

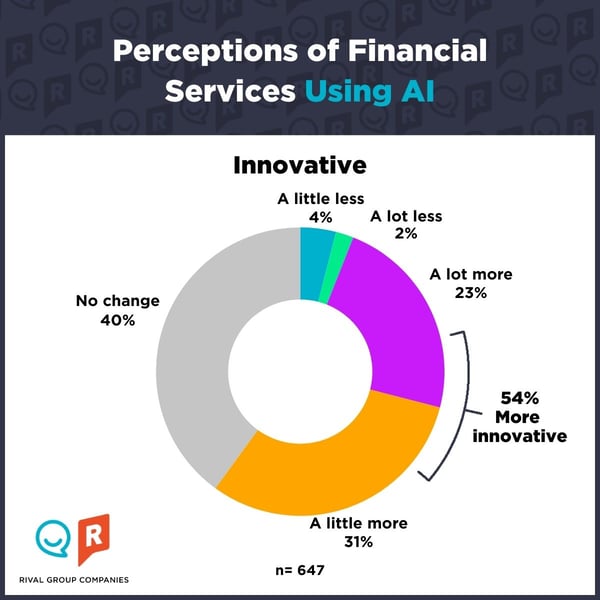

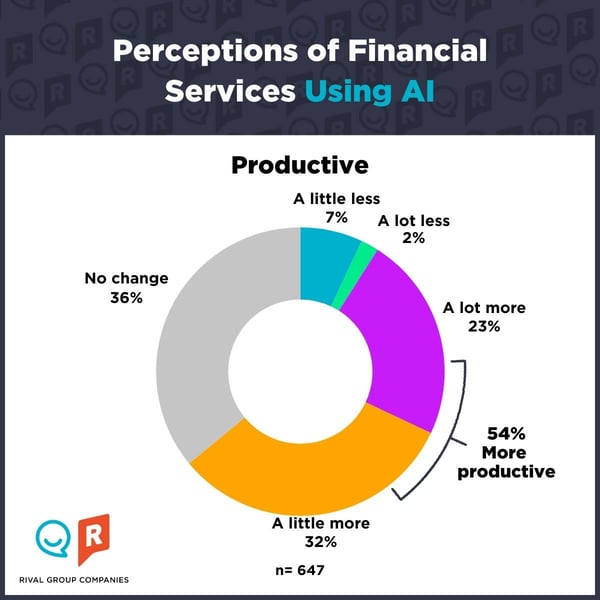

Despite some apprehension, most agree that banks/financial companies that use AI in finance are more productive (55%) and innovative (54%). Furthermore, based on their current understanding of the ways that AI is used in banks/payment apps/financial services, only a third (36%) feel that AI positively affects their trust in a company, with nearly half (46%) having no impact. AI usage has a higher impact on trust among Gen Z (37%) and Millennials (44%).

Despite these feelings, only a quarter of consumers today are more likely to work with financial brands and services that use AI, and half (52%) state that AI doesn’t play a role one way or the other in their willingness to work with a bank or other financial company. Our survey shows that consideration increases as consumers become more familiar and comfortable with AI—30% of those extremely familiar with AI are likely to seek out financial companies/services using AI.

Consumers don’t know much about how financial companies currently use AI

Despite limited awareness from the general public, the fact remains that financial companies do use AI in both customer facing applications and behind the scenes:

- Cybersecurity and fraud detection: financial companies use AI to spot fraud, monitor for cyberattacks, and make sure consumers are not wrongly flagged when making large purchases. Some examples: JPMorgan Chase, Mastercard, PayPal, Citibank.

- Chatbots: financial companies use chatbots to both (1) simplify routine customer service interactions and (2) deliver personalized content on an array of financial topics. These tools can help with account questions and basic transactions as well as provide personalized content on more complex topics such as budgeting and financial planning. Some examples: Cleo, Capital One, Wells Fargo Bank, Bank of America, Morgan Stanley.

Using AI for Cybersecurity and fraud detection has the most positive impact on perceptions of financial companies, with nearly half (49%) agreeing that this application of the technology improved their opinion of the use of AI in finance.

Opportunities to increase familiarity with current AI uses and create new offerings for Generative AI tools can be a game-changer for financial brands

Our survey suggests consumer sentiment towards AI in financial services is still evolving. We see a major awareness gap in the ways AI is used by banks, payment apps and other types of financial service companies. Our research reflects a timidness that suggests as education and understanding improves, so will overall sentiment.

By educating consumers about how financial services are currently using AI technologies, companies my attract new Gen Z consumers and bolster relationships with existing customers from older cohorts.

Financial companies can further entice consumers, particularly Gen Z, with newer, more transparent AI-augmented offerings. By the same token, AI can help financial companies create innovative new products, and services to enhance the user experience, as well as fuel new revenue streams.

Would you like to learn more?

If you're looking for more strategic insights into the strategic implications of AI in your industry let’s chat. We have experts in the tech and financial services industries who can help you navigate what's ahead.

Reach out to our team and see how we can work together.

About this study

Using our conversational research approach in combination with Rival’s mobile-first conversational research platform we engaged with nearly 650 US-based consumers between the ages of 15-60 to better understand their opinions about use of AI in financial services. To participate, participants must have been using at least one financial service, either a traditional bank/payment service (e.g., Capital One, Wells Fargo Bank, Visa, Mastercard, etc.) and/or an online financial service (e.g., PayPal, CashApp, Venmo, Robinhood, etc.).

Kassie Kelly

Senior Research Consultant

.webp?width=65&height=83&name=A-LIGN_HIPAA%20(1).webp)